Navigating the Impact of Financial and Economic Stress on Mental Health

We all know that financial and economic stress can significantly impact a person’s mental health. Financial stress often leads to heightened levels of anxiety and depression. Concerns about job security, mounting debt, and inability to meet financial obligations can cause a persistent sense of worry and hopelessness. This can manifest as insomnia, irritability, loss of appetite, and a decline in overall mental well-being.

Financial stress can strain relationships, as it often leads to increased tension and conflict within households. Couples experiencing financial pressures may argue more frequently about money, leading to a breakdown in communication and emotional distance. This strain can significantly impact the mental well-being of both partners, sometimes beyond their ability to manage together.

Experiencing financial hardship can also lead to feelings of shame and embarrassment. Society often associates financial difficulties with personal failures, leading to a perception of social stigma for those struggling with financial stress. This external judgment can exacerbate feelings of worthlessness and contribute to the deterioration of mental health.

Economic Stability vs Stress

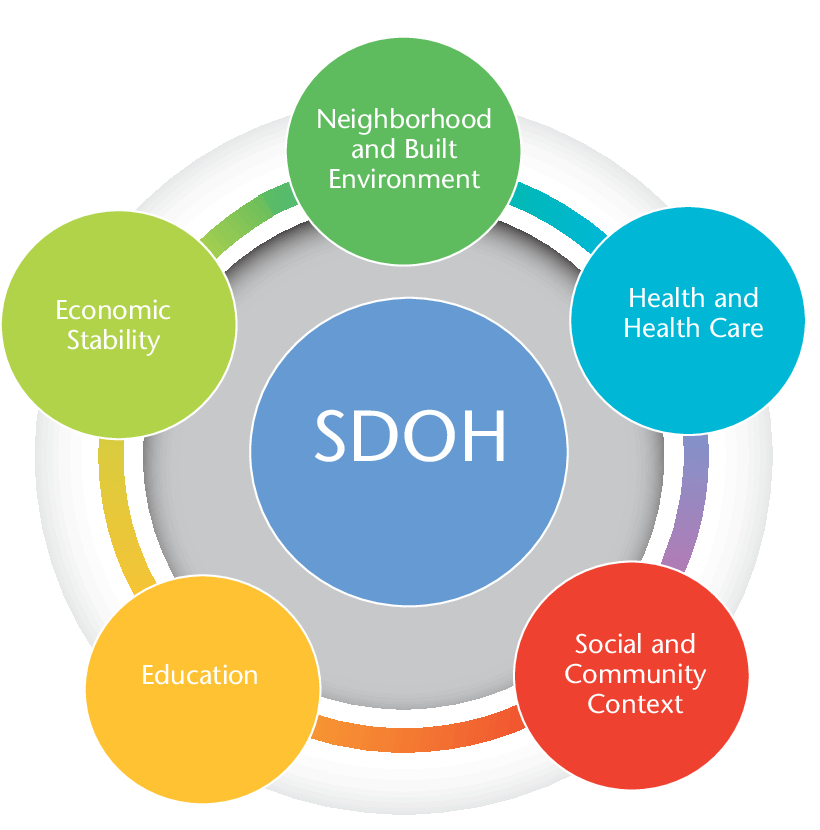

Economic stability is one of the social determinants of health, which are the conditions in the environments where people are born, live, learn, work, play, worship, and age that affect a wide range of health, functioning, and quality-of-life outcomes and risks. When our economic situation is stable and secure, that leads to better health outcomes, while financial and economic stress can take a toll on our physical health.

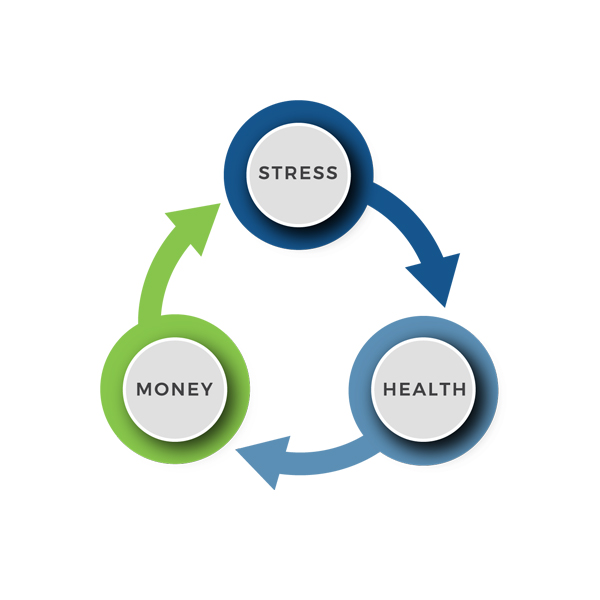

The chronic stress associated with financial difficulties contributes to increased blood pressure, heart disease, and other stress-related illnesses. These physical health consequences further exacerbate the negative effects on mental well-being, creating a vicious cycle that is challenging to escape. We often refer to that as the “causal loop” of money, stress and health.

And it’s essential to remember that the impact of financial stress is not limited to emotional or physical well-being. Studies have shown that financial worries can impair cognitive function, affecting a person’s ability to make rational decisions and think critically, which are the very skills we need to help us manage our economic situation. This cognitive decline can further compound the negative effects of financial stress on mental health, perpetuating a cycle that is difficult to break.

Breaking the Cycle

So how do we break that cycle? We know that can be a difficult task, given all of the challenges we’ve listed and the societal barriers that are more burdensome for some of us. There is no simple solution and the details will be different for each person. This situation is at the heart of why we created the Financial Health Institute and developed our Person-Centered Financial Education approach.

We know that the process starts with being gentle with yourself and others who are experiencing financial and economic stress. This can be a difficult journey with many detours on the squiggly path from start to finish, so patience is important as you take small steps. Build your awareness of the details of your situation that are within your control. Find meaningful support (whatever and whomever makes you feel supported) and when you’re looking at what you have available to help you improve your financial health, consider all of your assets, not just your income.

The implications of financial and economic stress on mental health are numerous and significant. From anxiety and depression to strained relationships and physical health consequences, the toll of financial hardship extends beyond monetary concerns. Recognizing the profound impact of financial stress on mental health is crucial for all of us: individuals, community members, policymakers, and service providers. Addressing this issue requires comprehensive support systems, including access to mental health services, resource navigation, and social support networks along with effective person-centered financial education to help individuals navigate the challenges posed by financial and economic stress.