Is April Financial (Literacy, Empowerment, Capability) Month?

April is …wait… Is it Financial Literacy Month…? Or is it Financial Empowerment Month…? Or is it Financial Capability Month?

This month, we wanted to acknowledge that April has been identified as a month to raise awareness around financial literacy. However, I have a strong resistance to that term.

“Financial literacy” has become a buzzword that people use to oversimplify a bigger issue and, as it is currently set up and delivered, I don’t believe that it ...

Read MoreHelping Immigrants Navigate American Financial Education

Ever find yourself feeling like you’re in uncharted waters when it comes to navigating the American economy? For immigrants and refugees, this is not only just a feeling that comes from time to time – it is their daily reality. Navigating the economic terrain of the United States can already be like trying to solve… Continue reading Helping Immigrants Navigate American Financial Education

Read MoreNavigating the Impact of Financial and Economic Stress on Mental Health

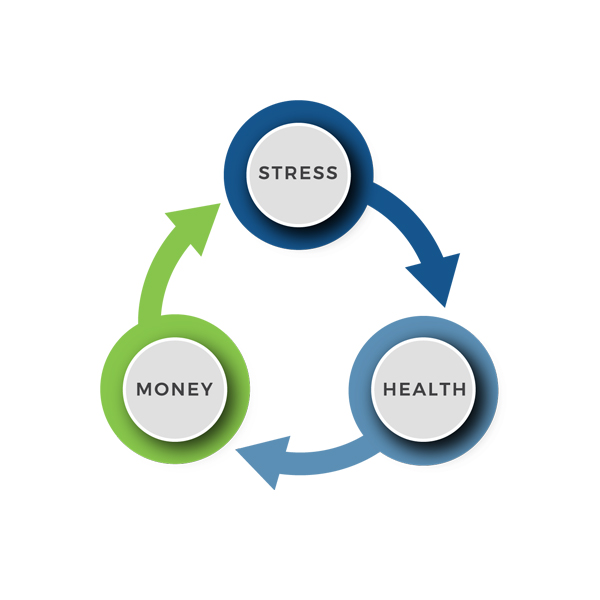

We all know that financial and economic stress can significantly impact a person’s mental health. Financial stress often leads to heightened levels of anxiety and depression. Concerns about job security, mounting debt, and inability to meet financial obligations can cause a persistent sense of worry and hopelessness. This can manifest as insomnia, irritability, loss of… Continue reading Navigating the Impact of Financial and Economic Stress on Mental Health

Read MoreHow Parents Can Help Their Kids Learn Financial Health

We get asked by parents how they can help their children learn about financial health, often with the goal that the children would not “repeat the same mistakes that I made.” Many parents assume they need to wait until a child is school age or even a teenager before they can start learning about these… Continue reading How Parents Can Help Their Kids Learn Financial Health

Read MoreFocus on Foundations

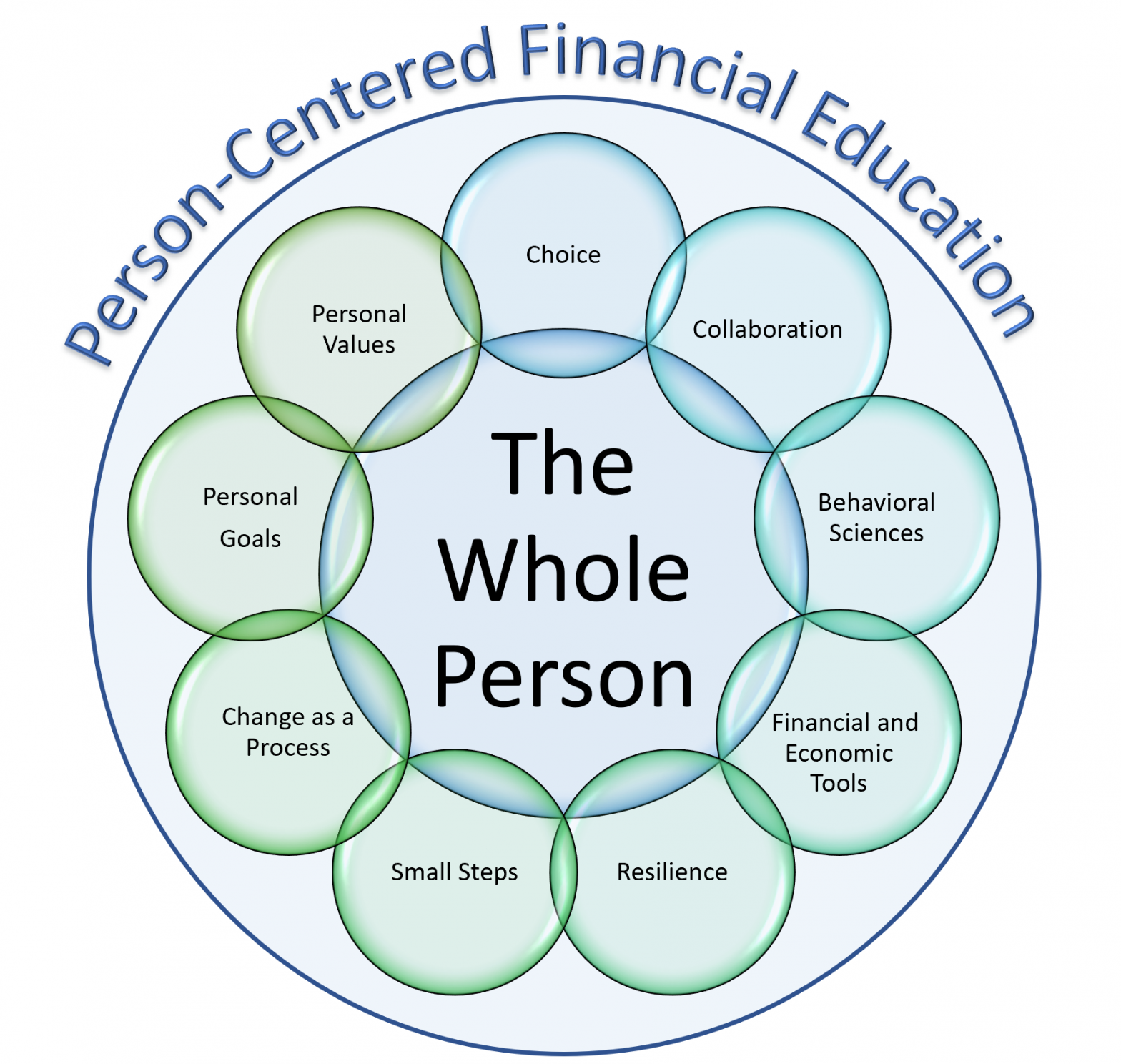

FHI developed the “Cornerstone – Foundation in Financial Health” program (originally called “Bootstraps Asset Building Education”) almost 15 years ago. Since then, we have delivered the program across the country, helping tens of thousands of people with this new, more effective approach to financial education. Person-Centered Financial Education at Our Core Through the development and… Continue reading Focus on Foundations

Read MoreFHI Celebrates 16 years of Person-Centered Financial Education

16 years serving our community! That’s what we are celebrating today! And we celebrate by dedicating our future efforts to integrate Person-Centered Financial Education into the world of human services and economic development. Sometimes, it takes time to get clear on what you’re doing or where you’re going. Sometimes, you just keep moving forward, knowing… Continue reading FHI Celebrates 16 years of Person-Centered Financial Education

Read MorePerson-Centered Financial Education

At FHI, our goal is to create and deliver effective, safe and fun financial education for people experiencing economic stress. We know this requires a special approach to financial education for us to successfully reach people who are confronting significant challenges in their daily lives. The standard way of delivering financial education won’t be good… Continue reading Person-Centered Financial Education

Read MoreFinancial Health Skills Building Project

It seems obvious that there is a strong relationship between a person’s financial health and their employment. Employers may know that their employees’ financial stress is causing issues on the job (in the forms of absenteeism, presenteeism, lost productivity, theft, accidents, and ultimately physical and mental health issues), but have rarely had substantial support to… Continue reading Financial Health Skills Building Project

Read MoreFHI Transitions to a Nonprofit

In April, FHI started the process of transitioning into a 501c3 nonprofit organization. Due to the nature of our work and the direction we see the organization moving into the future, we felt that it would make more sense for us to operate as a nonprofit and that now was the time to make that happen!… Continue reading FHI Transitions to a Nonprofit

Read MoreFHI Turns 15

15 years ago, a small nonprofit organization aimed at providing “Life Skills Education” was launched in Louisville, Colorado. Over the years, that organization has evolved to become the Financial Health Institute, the premiere financial health and personal economics education provider throughout the Rocky Mountain Region. For 15 years, we have designed, developed and implemented quite… Continue reading FHI Turns 15

Read MoreCurriculum Development at FHI

This summer, FHI’s curriculum development team has been working on numerous projects, including a series of asynchronous online courses focused on different significant points in a marriage: divorce, and a marriage impacted by an unexpected major financial event, or economic shock. The courses focus on the economics of divorce and co-parenting, from the beginning stages… Continue reading Curriculum Development at FHI

Read MoreTrauma Informed Organizations

It’s wonderful to see how many people are learning about Trauma-Informed Care in order to provide services that are responsive to the needs of their clients. There is a growing awareness that we need to take care of ourselves, too, in order to continue to provide quality services (and to become more resilient in our… Continue reading Trauma Informed Organizations

Read MoreHow Does Motivational Interviewing Relate to Financial Health?

How does Motivational Interviewing (MI) relate to financial health? Many people think of MI as a counseling technique or an approach to working with addictions, but it’s really an approach for helping people make changes in their life. In the words of Bill Miller, “Motivational Interviewing is a person-centered, goal-oriented method of communication for eliciting… Continue reading How Does Motivational Interviewing Relate to Financial Health?

Read MoreDigital Access is Fundamental

by Joanne McLain More and more, we are realizing that digital competencies are an essential part of financial health. Our society functions online for so much of what we need in life, from interacting with government agencies, to shopping for food and clothes, to getting a job and performing on the job, to education and… Continue reading Digital Access is Fundamental

Read MoreA Plethora of Passwords

By Kelley Presley, Curriculum Development Specialist and Tech Coach With so much of our personal, confidential information being stored and shared online, it’s more important than ever to be aware of the passwords we use to secure our online accounts. Passwords are your defense between your sensitive information and those who may be trying to… Continue reading A Plethora of Passwords

Read MoreMaking Real Connections

In the middle of difficult situations, navigating difficult materials and having meaningful and sometimes very difficult conversations – we never forget that there is a real person who is receiving our services.

Read MoreThriving in a Virtual World

We have had a busy summer adapting and adjusting to the changes around us and, as a result, we are thriving in our virtual world! We want all of you to thrive along with us, so we have several new projects that we are ready to share, as well as one major exciting announcement. Let’s… Continue reading Thriving in a Virtual World

Read MoreFinancial Health in Challenging Times

Hello friends and colleagues! I hope this correspondence finds everyone doing well, staying safe and healthy! A statistic that we have frequently referenced in the past indicated that over 60% of Americans didn’t have the savings to cover a $500 emergency. Obviously, none of us knew that we were on the precipice of a significant… Continue reading Financial Health in Challenging Times

Read MoreFHI Has Experience with Integrating Online Learning into Our Training

The last six weeks have been pretty crazy and we know you’ve been hit with a ton of correspondence from different organizations. The whole situation has been overwhelming for sure, and the stress makes it harder to focus on learning. I hope that this newsletter finds you, your organizations and families all doing well. We… Continue reading FHI Has Experience with Integrating Online Learning into Our Training

Read MoreA Great Start for 2020

Happy New Year! I hope that 2020 is off to a great start for you and your organizations. We had an amazing year in 2019 and we will be publishing our annual report at the end of this month highlighting some of our accomplishments. Two big projects that we will continue to grow in 2020… Continue reading A Great Start for 2020

Read MoreThe Leadership Academy

Beginning September 1st, 2019, the Financial Health Institute will launch The Leadership Academy (for Health and Human Services), an innovative approach to integrating a competency-based, comprehensive learning experience into professional development where outcomes can be tracked over time. As I am sure you are aware, there are many potential frustrations when you consider how training and… Continue reading The Leadership Academy

Read MoreWhat Can We Do About the Cliff Effect?

Over the past several months, as I’ve delivered the Frameworks in Financial Health class across Colorado, I’ve noticed a tremendous appetite for conversations about how we might better impact/inform policy. The curiosity usually starts from a conversation we have about the economic value of benefits, which then leads into a conversation about the “cliff effect.”… Continue reading What Can We Do About the Cliff Effect?

Read MoreFrom Organizational Scarcity to Integrated Learning

We all know what scarcity feels like, but how does it impact our lives and what can we do about it? And how does scarcity impact the organizations that are helping people address the scarcity in their lives? In 2013, Mullainathan and Shafir released a book about it called, naturally enough, Scarcity. The research and findings… Continue reading From Organizational Scarcity to Integrated Learning

Read MoreOur Evolving Organization

I’m pretty excited! On February 27th, FHI turned 12 years old. Of course, we haven’t always had the same name, and we have evolved a lot over that time. I will spare you a long list of accomplishments, but I am proud of the work we have done and the great training we have provided. Perhaps… Continue reading Our Evolving Organization

Read MoreBe The Change

One of the questions that we are most frequently asked at FHI is “how do you begin the conversation about money with a client?” I think this question is very interesting and revealing. Stick with me for a minute and let me see if I can work my way back around to this… A statistic… Continue reading Be The Change

Read MoreConversations in Economic Mobility

An Apology – sort of: I think a typical blog starts with an apology for not having written something sooner! Okay – so it’s later than expected, but here it is. And just so everyone knows, for the blog/newsletter topics for 2019, I am going to be focusing my efforts around the concept of Economic Mobility. … Continue reading Conversations in Economic Mobility

Read More