Economic Trauma

Do you believe a person’s financial or economic situation can create trauma?

In 2012, FHI came up with its own definition of “financial health” to more accurately describe the relationship between financial/economic situations and the overall state of a person’s well-being. Over the course of 13 years, we have been witness to tens of thousands of people who are struggling with their financial and economic lives. Our work has very deliberately looked at the impact of stress and scarcity on our health and our decision-making.

What we have come to believe in our experience is that people who are chronically stressed about their financial and economic situation for extended periods of time or who experience a devastating financial or economic experience are in fact traumatized by the experience. Below are some terms and definitions in an attempt to define “economic trauma.”

In 2012, in order to bring a definition of financial health into alignment with the World Health Organization’s definition of health, we put forth the following terms:

- Financial Health is the dynamic relationship of one’s financial and economic resources as they are applied to or impact the state of physical, mental and social well-being.

- Financial Stress is anxiety, worry, or a sense of scarcity, accompanied by a physiological stress response in the body, that results from financial and/or economic events.

- Economic Shock is an unanticipated expense that exceeds a person’s readily available resources. Economic shocks typically involve forced situations that complicate keeping a job, maintaining health, taking care of family, or keeping a home habitable.

What is Trauma?

The American Psychological Association defines trauma as “an emotional response to a terrible event like an accident, rape or natural disaster. Immediately after the event, shock and denial are typical.

Longer term reactions include unpredictable emotions, flashbacks, strained relationships and even physical symptoms like headaches or nausea.”

Trauma is an intense emotional and physiological response to an event (or series of events) that challenge a person’s ability to maintain a sense of normalcy. A traumatized person feels overwhelmed by what they are experiencing, to the point where they feel their own existence is threatened, or the existence of people they love. Life itself feels unsafe. The resulting emotional, behavioral and physical symptoms are a natural attempt to maintain some sense of control during and after an experience that feels totally out of control.

Economic Trauma and Abuse

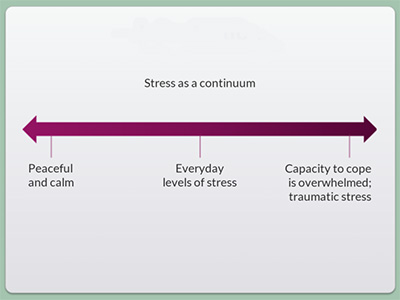

When stress becomes severe, the result can be trauma. Long-term, moderate levels of stress could also lead to trauma through a gradual breaking down of a person’s resilience. If you think of trauma as being on the extreme end of a continuum of stress that runs from peaceful calm at one end, through what’s considered “everyday” levels of stress, into overwhelming stress, it becomes easier to see how economic shocks like a debt that is in collections or unpaid bills can create a trauma response in many people, including unpredictable and intense feelings, perseveration about a past event, difficulty focusing or problem-solving, shock, denial, and even physical symptoms.

At FHI, we explain that money is a tool, a neutral object that we use to move around goods and services, but it is human nature to imbue it with multiple emotional meanings. In our society, we place a high value on money and set many barriers in place to limit what people without money can do. These barriers can often create sudden economic shocks like foreclosure or bankruptcy, or the long-term traumatic grind that builds up over time. The most obvious example of the trauma that limited money can cause is in the effects of poverty.

In order to describe the effects of financial stress and economic shocks, we developed this definition:

Economic Trauma occurs when financial stress and/or economic shocks impact a person’s feelings of safety, their ability to remain calm, manage healthy relationships with others, and maintain the belief that their situation can improve, which can lead to an impaired ability to function in daily life.

Economic Trauma can result from intentional actions by another person (which can be considered economic or financial abuse), or from the unintended effects of natural disasters, changes in the economy, systemic factors, or the actions or inactions of a person, group of people or organizations. It can result from a single acute economic shock, from a series of shocks or from the gradual accrual of stress brought on by a person’s difficult economic situation.

Because a common response to trauma is a foreshortened sense of the future, it can be difficult for some clients to make plans and follow through on them. Obviously, since the point of budgeting is to make a plan for the future, this is something to consider. In addition, since traumatic responses often involve difficulty with executive functions like problem-solving, decision-making, impulse control and focusing, the tasks involved in setting and managing a budget can be daunting.

Many clients who have been “in the system” for a few years have been presented multiple times with budgets to fill out and “stick to,” without the support for them to manage their stress, scarcity and trauma reactions. As a result, many clients feel like they are a failure at budgeting and can’t manage money. Our attempts to teach them how to budget often result in retraumatizing them rather than helping them build their skills.

Fostering Resilience

Resilience is the ability to bounce back, or rise above adversity as an individual, family, community or service provider. The effects of trauma are mitigated by awareness, perception, physical action, and other resiliency factors.

A person who is recovering from trauma often feels powerless to make positive changes in their life, so support and encouragement for working on their goals can help them build a sense that they do have some control. This sense of powerlessness can make the process of working on goals difficult, however, which is a good reason to focus on very small steps, and celebrating each achievement, no matter how small.