Our Results

During 2022

Live Classes and Training

- 306 classes delivered

- 2265 people served

- 111 different agencies

Online Learning

- 1540 courses completed

- 88% rated 5 stars

- 84% completion rate

- 4 courses completed/person

Participants arrive at Financial Health Institute courses feeling stressed about money.

- 71% of participants report feeling significant stress from managing their personal finances

- 60% of participants feel anxious or fearful about personal finances

- 77% of participants believe that, if they could control their spending, they could significantly reduce the amount of stress in their lives

Participants who complete a Financial Health Institute course believe they are ready to make changes.

- 98% of participants believe they will start saving money or change their spending habits as a result of the class

- 48% of participants have already started changing their saving and/or spending behaviors by the end of the class

87% of participants are making a range of important changes in their lives. Some of the changes include:

- 84% of participants are more aware of choices and spending behaviors

- 69% of participants are improving their savings

- 64% of participants are changing their habits

- 64% of participants are using budgets

- 49% of participants are working on reducing their stress

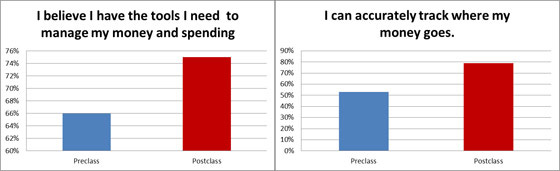

Financial Health Institute course participants feel more confident about managing their behaviors.

- 73% of participants are confident about creating and sticking to a budget

- 73% of participants believe they can prevent or manage their stress

- 71% of participants are clear about their spending priorities

Testimonials

I walked away from the training with a variety of tools to help me continue processing and understanding the role of money at an individual and societal level. It was, without question, the most meaningful training I’ve attended, and I highly recommend it for all levels of staff who are looking to better understand their own thoughts and actions around financial health.

I was extremely happy and challenged with this class! I love to learn and I learned a lot about emotions & finance, budgets, spending.

Everything was very thought provoking and compassionate.

I actually have all the power that I thought was circumstance.

It made me aware of what I was spending, how I was spending, and if that lined up with what I value most.

Controlling spending takes more than being aware and I was very interested in the changes in behavior the class called for. It made me pay closer attention to the types of ‘deals’ I purchase, and made me look into where my money was really going.

Everyone I know who has taken the course had an epiphany and understood why it was important to save and set up a budget.

I am shocked how much better my life has changed by taking a few suggestions I learned from this class.

This is one of the most informative and stress reducing classes I have ever taken.

This was, without a doubt, the most effective tool I have experienced to make me re-consider my financial decisions. No lectures from my parents or financial planners or even Dave Ramsey and Suze Orman types had greater impact on the way I see money. Since participating, my credit score has improved, I have savings in the bank, and I am less wasteful. Using the tools I learned in the class allowed me to take immediate steps to eliminate the bulk of my financial stress. I’m just in a better place now.

The materials were incredibly insightful to both my own spending behaviors, as well as the larger cultural constructs that contribute to the ways in which we understand (and perhaps more importantly, don’t understand money). The instructor was enthusiastic, full of knowledge, and facilitated meaningful conversations throughout the training.